6 Winning Features in Fintech Mobile App Development

-

Ankit Patel

- December 26, 2018

- 4 min read

Technology has always helped the financial sector to adapt itself to the rapid changes. First was the advent of computers and the finance software. Next came the internet and along with it came a host of changes in the way finance was dealt with. Online transactions became the norm.

Now, with the penetration of mobile in every nook and cranny, the financial sector is also taking a leap into the mobile wallets and financial technology (fintech) apps.

Fintech is the portmanteau of the words financial technology. It simply means the use of advanced technology to aid financial services and products to the customer. The services could be in banking, insurance or investing.

How is the Fintech Mobile App Beneficial to the Customer?

Fintech is beneficial in the sense that they reduce the middleman commissions and bring down the transaction costs. With the penetration of internet and mobile technology in rural areas, the fintech apps are able to reach that section of people who are unbanked or under-banked.

Though initially, they faced a lot of hurdle regarding their security and trust, the customers are now gradually moving into online transactions for it is easy and fast. So now you have the fintech apps in insurance, loans, payment services, instant and international money transfers, asset management, and crowdfunding.

Features to be Included in the Fintech Mobile App Development Process

1. Integrated functionality with other fintech apps:

The fintech technology focuses at many sectors like insurance, payment transfer, asset management and so on. The fintech app development has to be designed so that the app can be integrated with many platforms. An advantage of wide functionality is that the apps when compatible with each other can easily interact and exchange information.

Take, for instance, joining all bank accounts or collecting information regarding the diverse investments all in one place. Also, the mobile app has to be cross-platform compatible. The wide functionality gives the customers a perfect business platform where integration is easy and hassle-free.

2. Onboarding:

For any fintech mobile app, the first registration process may involve that the user types in a lot of personal information that is quite necessary. This is because the financial services have to comply with a lot of regulations regarding the KYC (Know Your Customer) and anti-money laundering laws. The designing during the fintech mobile app development process should be such that the user gets a positive initial experience when using the app.

The registration forms have to be simple and easy so that the maximum information is collected with minimum input from the user. The mobile app has to convince the user of their reliability and value. The fintech mobile app development process has to be focused on designing forms that make the user understand the necessity of filling the data. Take for instance when filling the username, a small message can be displayed regarding the need to fill the same name as per the bank account for security purpose and so on.

3. Security:

Data security and data privacy are the major concerns that have to be addressed for the fintech app development process. Many of the users shy away from letting out their financial details as they fear the security of their data. Even though the fintech companies ensure that full regulation and compliance is followed, it is in their hands to assure that they have apt measures in place to evade a cyber threat or attack. For this, it is necessary that the fintech companies hire the services of that fintech app development company that already has expertise in this area with highly qualified app developers and experts.

The authentication process has to be very well designed and managed. Some security tips include the reentering of password when you have to edit the card details or address, lockout after few unsuccessful login attempts, and to display only the last three numbers of the credit card.

4. Best UI/UX:

The fintech mobile app development process has to see to it that the users get the best experience from that app. Though there is need for adequate data collection and management of the user, the design has to be such that it is hassle-free and seamless.

The advanced technology in the fintech mobile app development process makes the mobile app usage easy and enjoyable for the user. Some of the examples in this include- use of white spaces to focus on the information, definitions in simple terminology without using the technical jargon, picking up the right fonts and its size, and focusing on the color code for important buttons.

5. Accessible Data Analytics:

The fintech mobile app development process has to include features that will analyze the financial data and bring it out to the user. The users can track their financial activities and easily access their transaction history. For fintech mobile apps that are focused on asset management, the analytics has to be on investment returns and suggestions based on it. A visual representation always helps them to understand and comprehend the data better. It will also give them insights into their spending, saving and investment habits.

6. Artificial Intelligence for Personalization:

The trend is the increased dependency on artificial intelligence to get more interactive with the users. The use of complex arithmetic processes like the machine learning helps the fintech companies to provide smart answers and suggestions to the users on their spending and investments.

Hire a fintech app development company that is well-versed in AI like the inclusion of chatbots so that the customers get a one-to-one interaction thus improving the customer service. The use of artificial intelligence also helps in marketing products based on user preferences. The right fintech app development process includes promotions to be customized and delivered to the users directly with the use of analytics and AI.

Conclusion

Whether it is providing financial solutions or adding integration options for third-party fintech apps, there is a lot of scope in the new fintech technology. With the right feature implementation in the fintech mobile apps, there is no way that you can fail in providing the best fintech app for your customer.

You may also like

How to Choose the Right Mobile App Development Company

-

Ankit Patel

Imagine this: you’ve got a brilliant app idea that could revolutionize your business, take it to new heights, and transform your entire customer experience. But without the right team to… Read More

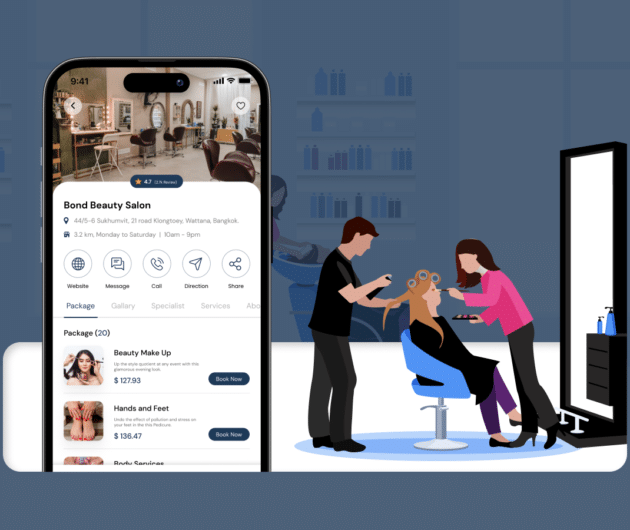

How Much Does it Cost to Build a Salon Booking App like Fresha?

-

Ankit Patel

We all have witnessed the buzz in the world of beauty & wellness, and it’s booming every day thanks to the fast-paced and stressful lifestyle. In an era where time… Read More

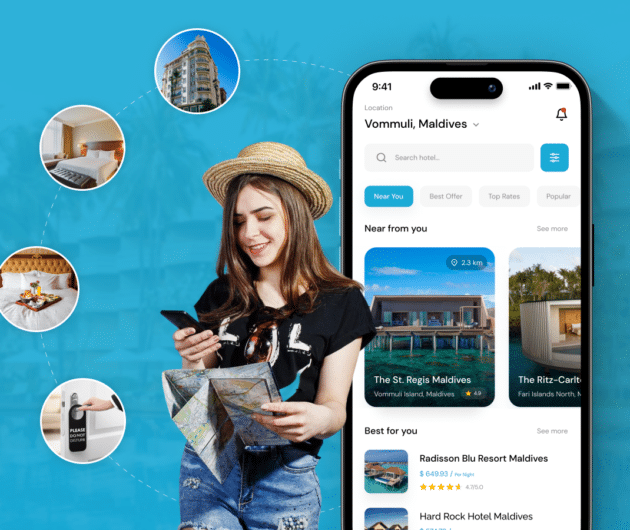

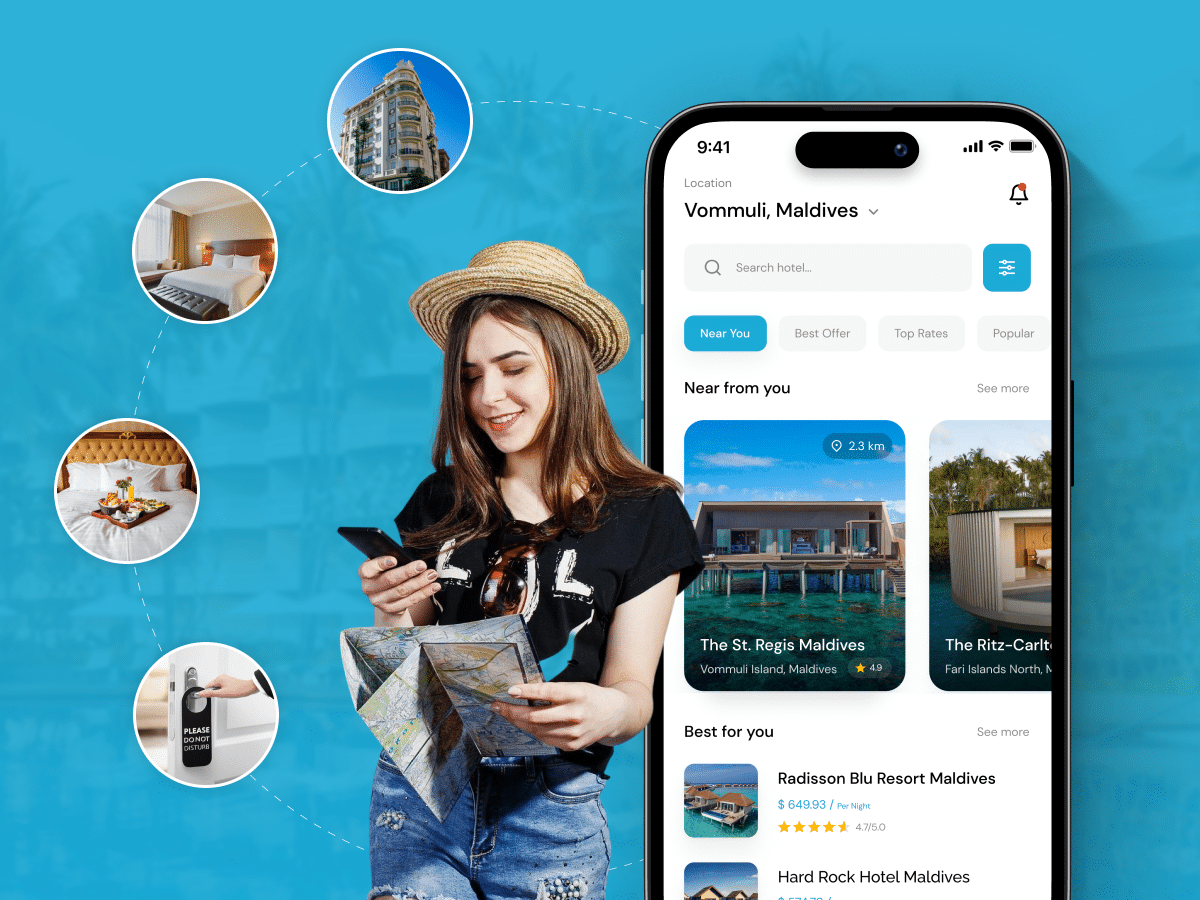

A Complete Guide to Hotel Booking App Development With Cost

-

Ankit Patel

Whether it’s a corporate business trip or a relaxing vacation with friends, finding the right hotel at the right time and a seamless hotel booking experience is not a luxury… Read More