How Can Machine Learning Be Useful For Fintech Industry?

-

Ankit Patel

- January 13, 2020

- 5 min read

There is a high demand for ML in Fintech and every day you can notice that the demand is continuously increasing. As we know that banks and various other financial bodies strive for beefing up security, improving financial analysis and streamlining processes and this is the reason why machine learning today is the most preferred technology.

As per machine learning development company, ML can significantly play an essential role in the success of a Fintech project as it helps in protecting data and enhancing customer engagement. Today, machine learning is a very common phrase used in the Fintech industry, but there was a time when the conservative Fintech industry ignored machine learning and was least interested in adopting machine learning solutions. With machine learning, financial forecasting, data security, and customer service can be carried out even more efficiently.

Here in this context, you will get to know ML’s most famous use cases in Fintech and discover how ML works for Fintech and why you should take Fintech app development services.

1. Security

Machine learning is excellent at finding out frauds. Banks make use of this technology for monitoring numerous transactions. Machine learning solutions can quickly spot fraudulent behavior or activity with high accuracy and spots mistrustful account behavior. ML can evaluate a transaction at lighting speed. This speed helps in preventing real-time frauds. Other than this, this technology can efficiently spot fraud even after its occurrence.

2. Financial Monitoring

Data scientists prepare a system for detecting a huge number of flags and micropayments. Financial monitoring can prevent smurfing – a technique that is used for laundering money. ML algorithms can radically augment network security. It is believed that in the coming period, many machine learning development company will offer this ML technology that will power sophisticated cyber-security networks and assist them in monitoring financial activities.

Companies like Skrill, Adyen, Stripe, Paypal, Payoneer, and Stripe are some of the famous Fintech companies that invest a great deal in security ML.

3. Machine Surpass Predictive Analysis

Many financial bodies have today shifted to ML algorithms from established predictive analysis method for forecasting financial trends. With machine learning algorithms, it has become easy for financial specialists to spot market changes rapidly in comparison to those traditional methods. Machine Learning algorithms in the Fintech industry can forecast market risk, discover future opportunities and reduce fraud.

In many ways, on hiring this technology can diminish financial risks, like:

- ML algorithms are capable of analyzing a continuously large number of data (such as loan repayments, company stocks or car accidents) and forecast trends with which insurance and lending can get impacted.

- There are systems that warn early about any fraud. ML can be applied to those systems. ML-backed warning systems are used by banks as well as other financial bodies for predicting anomalies, reducing risk cases, obtaining recommendations on steps to take on the occurrence of fraud and for monitoring portfolios.

4. Insurance

As per a survey conducted by the Coalition Against Insurance Fraud, across all insurance branches, fraudsters steal about $80 billion in a year. Machine learning-powered systems can spot anomalies or unusual behavior and flag those detected activities. ML algorithms provide the insurance agencies with complete information on doubtful behavior. Not only this, the algorithms can even suggest remedial measures for resolving situations and shielding programs.

5. Investment Predictions

Machine learning provides Insights on Advanced Market. Using this technology, every fund manager can predict market changes beforehand which could have been not possible with those established investment models.

In a flash, ML technology can drastically alter the investment industry. Big institutions such as Morgan Stanley, JPMorgan, and Bank of America have already developed ML technology-powered mechanized investment advisors.

6. Fraud protection & fraud prevention

Fraud protection and prevention task when performed by humans used to consume ample time. If we have a glance at today’s scenario we will notice that in an amazing manner, machine learning solutions have replaced a whole host of a human workforce that was employed for detecting fraud and protecting the firm against it.

Machine learning holds the potential to consider several factors simultaneously and put all of them at one place for locating the threat. The technology spots the fraud patterns and threats by making use of predictive analytics and then guards against those threats by blocking the fraudulent activity or not permitting those activities to access any data or remove data’s vital information.

The hacking and cracking attempts that are received by the US government per day only from China are no less than 1 million. China would have succeeded if Fintech development services and ML would have not been there. ML technology counters their attempts and guards the US government data against being hacked or cracked.

7. Process Automation

By means of process automation, document analysis can be done more effectively. Also, the interpretation of data can be executed efficiently. Process automation helps in executing intelligent responses for identifying issues prior to their occurrence. Other than this, ML also carries out real-time analysis of the processes of an institution that result in regulatory compliance.

Automation has always replaced manual work, thereby automating repetitive tasks. But, as productivity is increasing day by day, ML enables financial bodies to enhance customer experiences, optimize costs, and scale-up their services. Process automation includes:

- Chatbots

- Paperwork automation

- Call-centre automation

- Employee training’s gamification

8. Network Security

Computer Virus, Trojan, Botnets, Zombies, Horses, and Worms are those viruses existing extensively. The biggest challenge for the Fintech industry was to trace out modern complicated cyber attacks as they can’t be identified with the pre-existing security software. For this, the industry had to hire Fintech app development services.

With the advancement in technology, ML security solutions can aptly secure the financial data. Intelligent pattern investigation coupled with vast data abilities makes machine learning security technology more superior than traditional, non Artificial Intelligence tools.

9. Customer Service

The biggest issue with every financial institution is for achieving their set targets; they lead their customers in the wrong direction. For gaining optimum profits, they often make attempts to exploit their customers. Hence, virtual assistants, unfairness can be trimmed down. The potential investors will be presented only the actual picture so that they get the correct information and prompt solutions and answers to their queries and problems.

Chatbots came into existence years ago, but their efficiency wasn’t that great. Today, with ML, chatbots are taught many things so that they can effectively deal with every customer’s requirements and address their queries. Machine learning helps the bots familiarize themselves with the customers on the basis of their behavior. Instead of following prescribed instruction sets, they can render customers services just like human beings.

10. Smart trading

The machine learning application is considered as the best tool for the Fintech industry as it provides consistent historical trends, a large amount of data, and the quantitative nature of data. For years, consumers have been using automated functions to trade in stocks, but today they are looking at the technology to provide them more precise data so that they can take trade decisions smartly.

The machine learning solutions can profoundly mine the huge number of data. With every data processing, it will deliver more accurate predictions. Human biases can be removed when complete trading decisions are taken by a machine. Also, the machine helps in making the right calculations and taking accurate trade decisions. With the advancement in technology, machine learning is having more sensible applications, which implies that ML will be an essential part of smart trading.

11. Digital Assistants

Sound management is a must in every company to carry out the tasks efficiently and effectively. The ML technology helps managers and executives execute their tasks with ease. Digital assistants when powered by machine learning offer the same services as a human being would have offered.

Google, Microsoft, Facebook, and Apple hired Fintech app development services and today each is having their individual virtual secretary version. Google’s Allo, Microsoft’s Cortana and Apple’s Siri presently represent the high-tech digital helpers.

ML makes digital assistants capable of learning behaviors and needs of a manager and responding aptly as per the situation.

Final Thoughts

From the above article you must have known that machine learning plays a vital role in the Fintech industry and how useful are Fintech development services. It is believed that ML will demonstrate its hidden potential in the coming period. Considering all these use cases of machine learning mentioned above, we can conclude that this technology is going to be very beneficial for the Fintech industry. You can also hire Fintech app development services to experience ML benefits.

You may also like

How to Choose the Right Mobile App Development Company

-

Ankit Patel

Imagine this: you’ve got a brilliant app idea that could revolutionize your business, take it to new heights, and transform your entire customer experience. But without the right team to… Read More

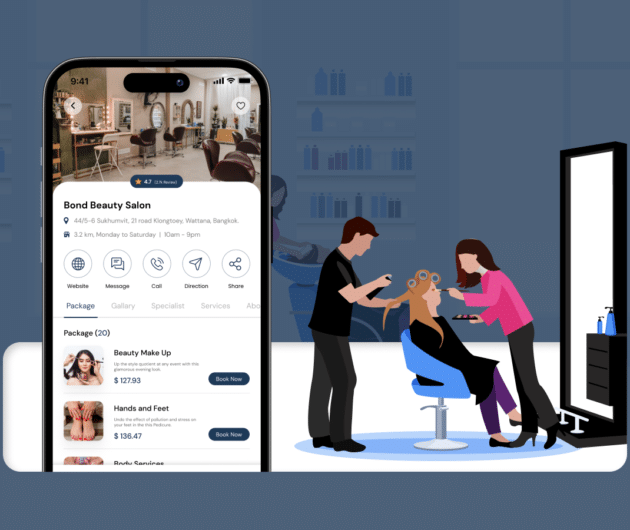

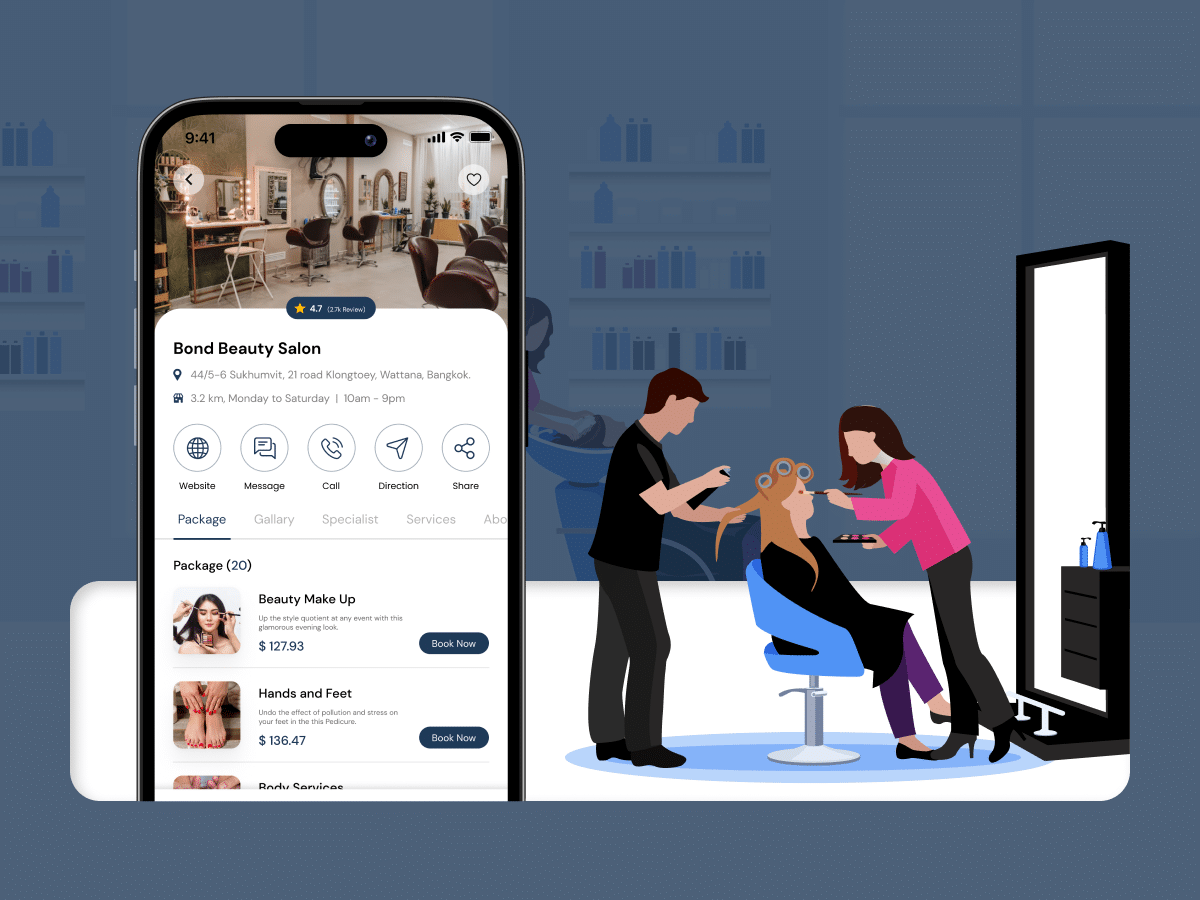

How Much Does it Cost to Build a Salon Booking App like Fresha?

-

Ankit Patel

We all have witnessed the buzz in the world of beauty & wellness, and it’s booming every day thanks to the fast-paced and stressful lifestyle. In an era where time… Read More

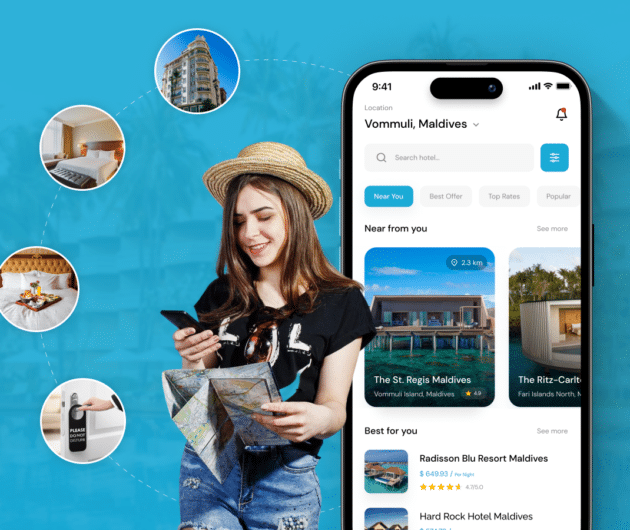

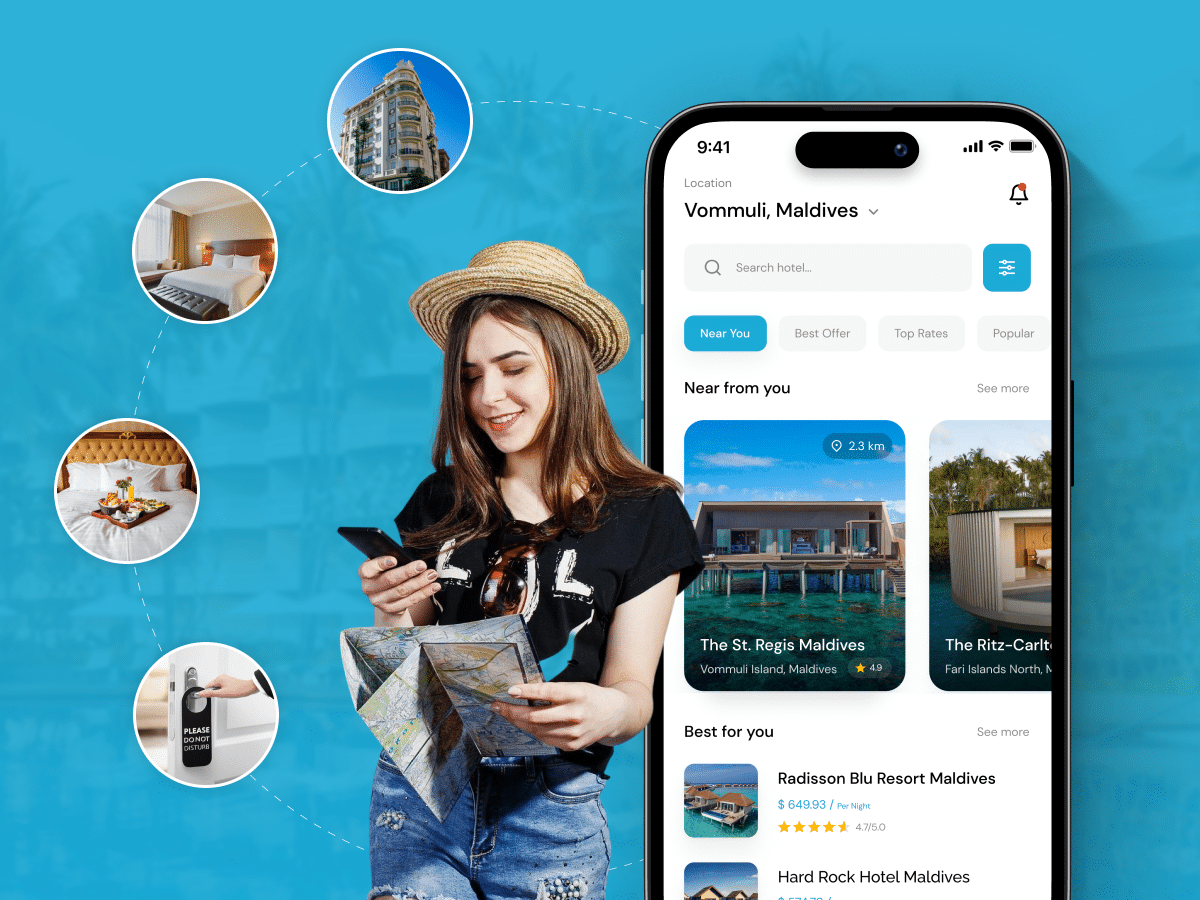

A Complete Guide to Hotel Booking App Development With Cost

-

Ankit Patel

Whether it’s a corporate business trip or a relaxing vacation with friends, finding the right hotel at the right time and a seamless hotel booking experience is not a luxury… Read More