How to Integrate Payment Gateway In Your Mobile Application?

-

Ankit Patel

- January 11, 2019

- 4 min read

Any online shopping would not be possible without the online money transfer, right? Or to say that the payment gateways were the reason that online shopping was possible would be more accurate. For any transactions in a mobile app to be successful, it has to provide its customers with multiple payment options. Imagine, today if you are able to sit at home and order your favorite food or book, it is largely due to the fact that the mobile app is able to collect payments from the customer.

• How is the payment possible through a mobile app?

For a payment transaction to be successful, the mobile app has to be integrated with a payment gateway. The payment gateway, the processing bank, card issuer, and the merchant together form the core of the payment process.

• What is a payment gateway?

A payment gateway is like a secure mediator between the mobile devices and the payment processor that is the bank. It simply authorizes the payment between the customer and the merchant via the bank.

• How does the payment gateway work?

1. For this, let us assume that a customer has placed an order for shopping from an online store or a mobile app. The customer fills in the details of the card on the mobile app card payment application form like the card number, name, expiry date, CVV number and so on along with the total amount.

2. This data is encrypted by the payment gateway and sent to the payment processor i.e. the bank.

3. The bank now sends this transaction data to the respective card issuer through Visa, MasterCard or any other payment network.

4. The payment system of the card issuer analyzes the solvency of the user and compares it with the purchase cost from the merchant. This request is viewed and either approved or denied.

5. On approval, it is sent back again to the processing bank through the payment network MasterCard or Visa.

6. The authorization from the bank is then forwarded to the merchant through the payment gateway.

7. Now, the purchased amount is debited from the customer’s card and transferred to the merchant account in a few days.

• How do you integrate payment gateway in the mobile app?

The payment functionality for in-app purchases is different. They can only be set up either through the Apple’s AppStore for iOS devices or Google’s Google Play Services for Android devices. Here, the integration with third-party mobile payments is not possible.

But when it comes to selling physical products or membership plans, then you can choose any of the payment gateways available. Some of the popular payment gateways are Stripe, Paypal, and Braintree. The payment gateway you choose offers Software Development Kits (SDKs) that contain the mobile platform libraries. These have to be integrated into your app during the mobile app development process. The libraries support the resulting software and reduce the risk of attacks. Moreover, it makes the integration process easy for developers.

• Considerations before selecting your payment gateway:

With so many payment gateways to choose from, you are really confused as to which is the best. Let us consider some factors that you need to consider before selecting a payment gateway to integrate with your mobile app-

1. What is the fee that is levied per transaction?

2. What are the package features that they provide?

3. How reputed is the company?

4. How good is their customer support?

5. Is their PCI DSS compliance measure in place and stringent?

6. How easy is the integration process through their SDKs?

7. Is it necessary to have a merchant account to complete the payment process?

8. How fast and hassle-free are their payment transactions?

9. If your business grows, does the payment gateway allow for scalability?

10. How fast is the settlement period?

• Some of the factors to be considered when integrating the payment gateway to your mobile app:

1. Data security:

Select a payment gateway that is PCI DSS compliant. But if you are a merchant, even you fall under the ambit of being PCI DSS compliant. There are the PCI compliance levels from 1-4 for a merchant. Your level depends on the volume of transactions processed by your app and the way you process them. The first step in this is to undergo the SAQ (Self Assessment Questionnaire). This describes the guidelines to remain PCI compliant.

For all those apps that provide online payment transactions in bulk, they must ensure that the entire process is PCI DSS (Payment Card Industry Data Security Standard) compliant. In case of an attack of the card details, then the merchant is liable to pay a penalty for the incident. In order to maintain compliance, the following steps are to be taken-

• Build a security network through the firewall configuration setup or other means in your app.

• Access control measures on your mobile app have to be implemented

• Test the network regularly using pen penetration testing.

• Use encryption and tokenization methods to protect the cardholder identity.

• Get regular audits done by the PCI payment gateway comptrollers.

The best solution is to take the consultation of PCI specialists in achieving compliance.

2. Easy integration:

Select that payment gateway that provides easy and hassle-free integration. Also, check if your payment gateway provides multi-platform support. And also, any updates should be easily inserted into the code without any major alterations. The size of the SDK also matters. It has to occupy minimum space on the user’s mobile device.

3. User Interface:

In any mobile app, it is necessary that the user interface of the payment gateway gels with your app design. Select the payment gateway that has a user-friendly interface with optimal design and fewer steps for payment processing. Many of the payment gateways provide customizable payment forms so that you can create a great page that seamlessly gels with your mobile app design.

4. Provide payment information to the customer:

Let the customer know of the payment processes taking place so that he remains informed of the verification and authorization stages of it. Also, in case of error, highlight where the mistake has occurred and why it has occurred. You can suggest the user try alternative payment methods if the payment through any of the card gets rejected. After the payment process is completed, email the receipt to the customer and also send a message on their mobile. Provide good customer support for any queries regarding the payment gateway and the payment process.

Wrap Up

Thanks to the payment gateways, the customers can now rest assured that their transactions are being processed faster and securely. Not only is it a win-win situation to the customer, but also to the merchant.

You may also like

How to Choose the Right Mobile App Development Company

-

Ankit Patel

Imagine this: you’ve got a brilliant app idea that could revolutionize your business, take it to new heights, and transform your entire customer experience. But without the right team to… Read More

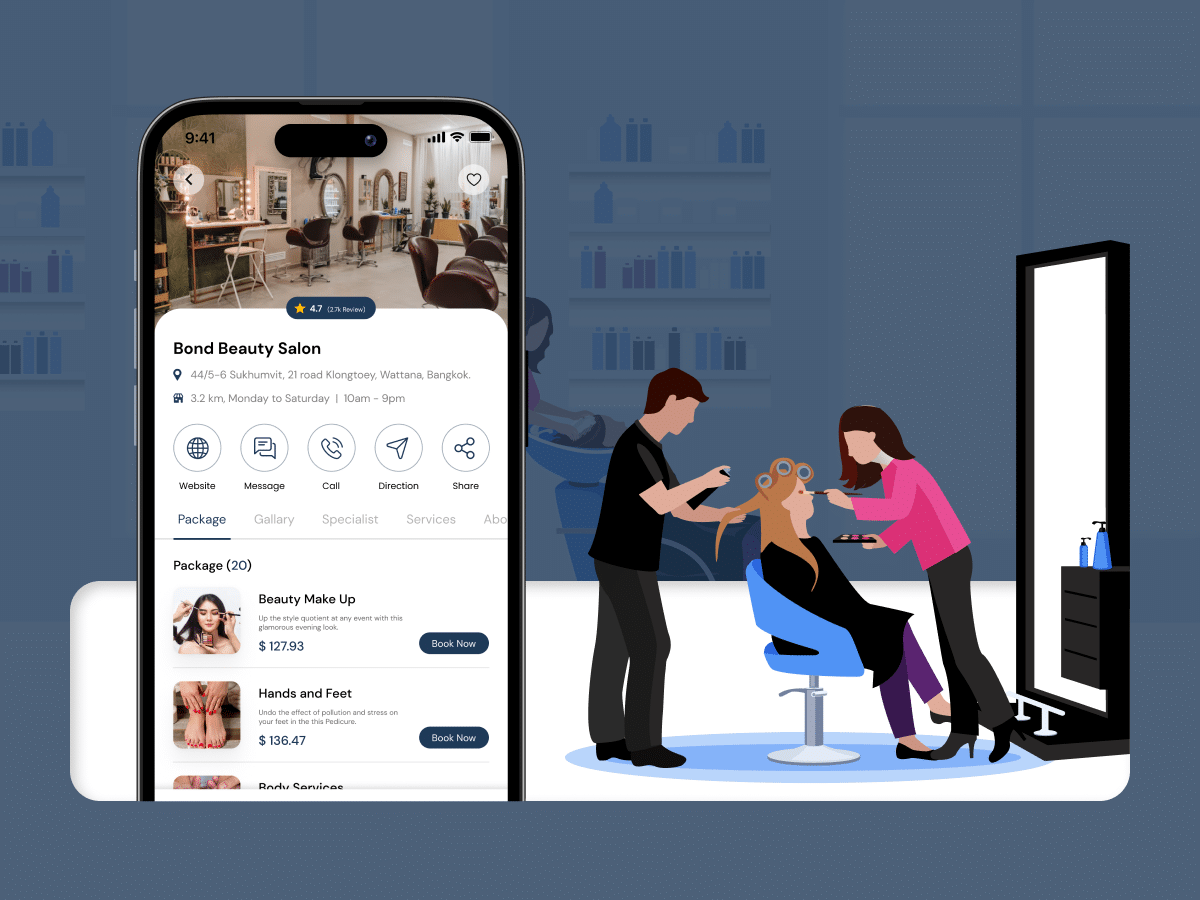

How Much Does it Cost to Build a Salon Booking App like Fresha?

-

Ankit Patel

We all have witnessed the buzz in the world of beauty & wellness, and it’s booming every day thanks to the fast-paced and stressful lifestyle. In an era where time… Read More

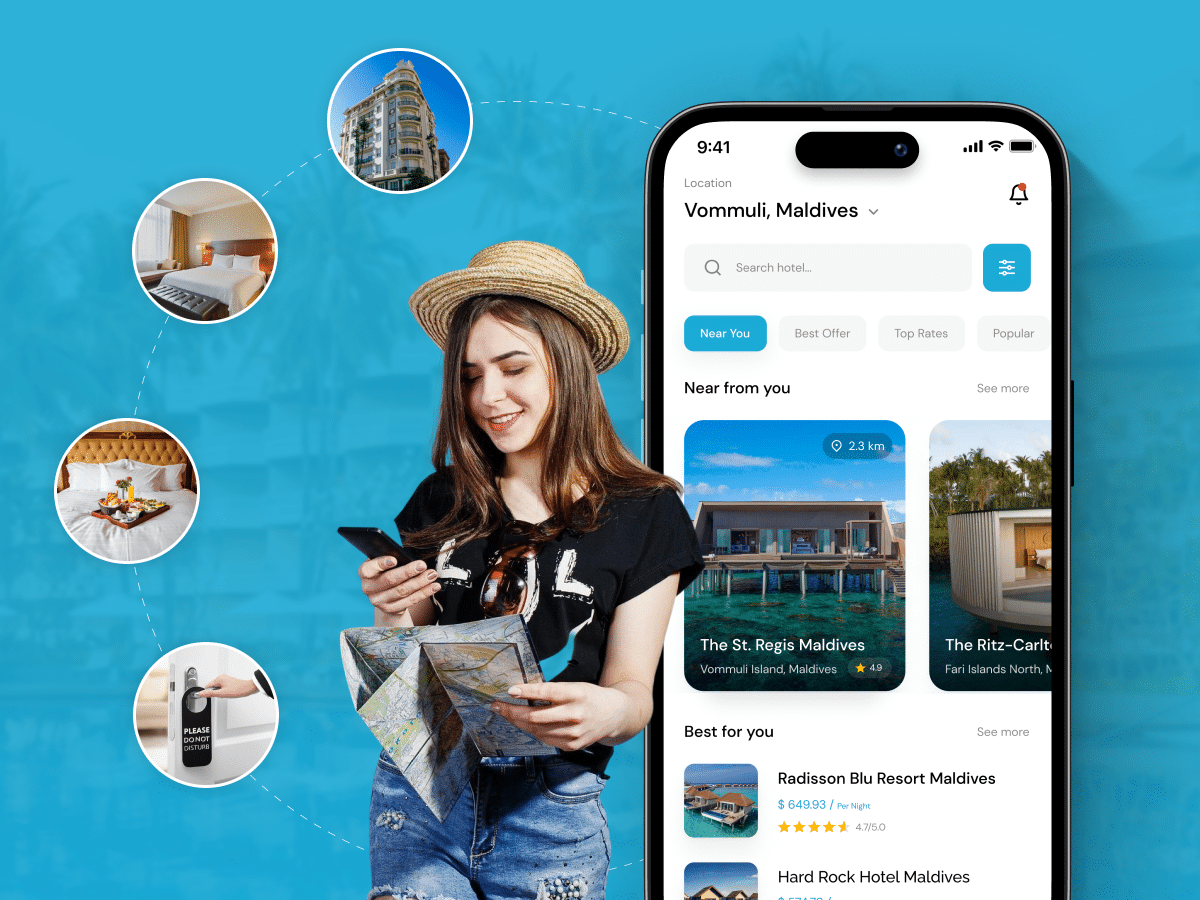

A Complete Guide to Hotel Booking App Development With Cost

-

Ankit Patel

Whether it’s a corporate business trip or a relaxing vacation with friends, finding the right hotel at the right time and a seamless hotel booking experience is not a luxury… Read More